Enhancing Customer Experience with Split Payments

Split payments are a versatile payment method where multiple payment sources are used to pay for goods or services, either by an individual or a group. They can also be used to divide the cost of an item into instalments over a period of time. This approach to payments offers numerous benefits, including convenience, accessibility, and a streamlined customer experience.

One of the most rapidly growing use cases for split payments is buy-now-pay-later (BNPL), which enables customers to divide payments over time. This option has gained immense popularity, with leading BNPL companies like PayFlex, Lipa Later, MoreTyme, and Sympl experiencing significant growth.

Another use case for split payments is in group settings, such as restaurants, where multiple parties contribute to the bill using different payment methods. In such scenarios, split payments ease the transaction process and minimize friction amongst the group.

The rise of payment apps and digital wallets has made splitting payments easier. Some popular split payment platforms include:

FNB Geo Payments: Geo Payments is an innovative payment solution that leverages geo-location technology to provide users with a seamless payment experience. Geo-location technology utilizes a range of technologies, including GPS, Wi-Fi, cellular networks, and IP addresses, to determine the precise location of a device or individual.

FNB Geo Payments is a popular payment service that enables users to send and receive money instantly within a 500-meter radius without the need for inputting any banking details or phone numbers. This feature makes it incredibly convenient for groups to split bills or send money to a designated payer to settle a shared expense.

Zapper: QR codes are a type of two-dimensional barcode that uses a visual, machine-readable format to represent data. In today's world, QR codes have become an increasingly popular tool for making contactless payments using a mobile application.

Zapper is a mobile application that simplifies the payment process and e-commerce experience for both merchants and consumers. The app enables merchants to accept payments using QR codes and credit cards on their mobile devices. Consumers, on the other hand, can link their debit/credit cards to the Zapper app and make payments by scanning a merchant's QR code. The app also simplifies the process of splitting payments or bills by allowing payees to manually input the number of people splitting the bill and tip, or split the bill by separate amounts until the full amount is covered.

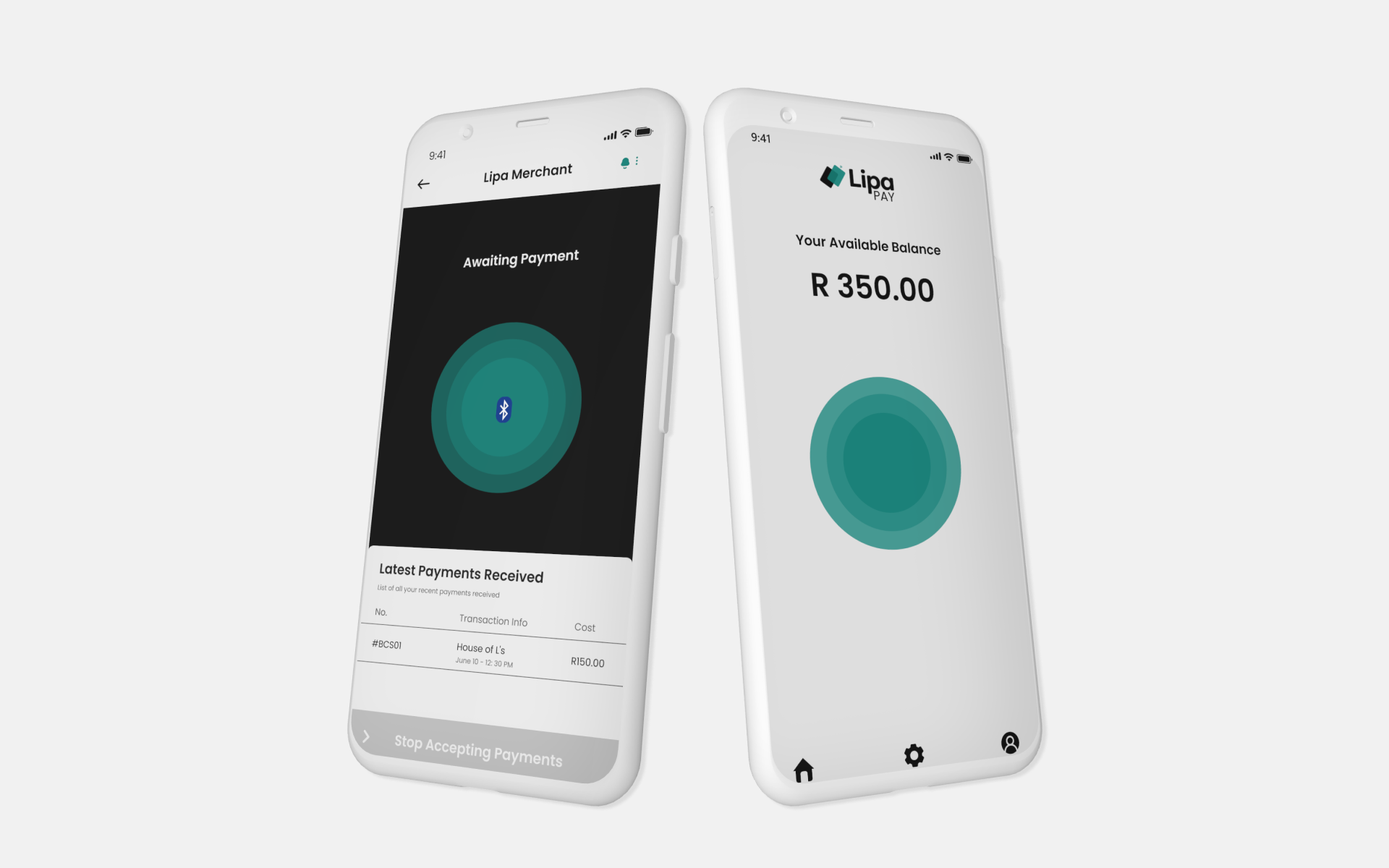

Lipa Pay: Lipa Pay leverages Bluetooth Low Energy (BLE) technology to offer payment experiences that cannot be achieved through NFC or QR codes. What sets Lipa Pay apart is its accessibility, as even low-end smartphones with Bluetooth capabilities can accept BLE payments. Unlike other payment methods, BLE payments do not require a stable network connection or mobile data, making it a reliable and convenient option for consumers.

Using Lipa Pay, consumers can easily pay for their share of a bill directly from their mobile phones. Peer-to-peer payments are seamless and hassle-free, as there's no need to manually input any proxy information, such as an account or phone number. Simply click a button to search for nearby payees, select the person's name, and complete the payment. With Lipa Pay, split payments have never been more convenient and accessible.

Overall, split payments make transactions more accessible, reduce friction in group transactions, and improve customer experiences.

You can learn more about BLE payments in our

BLE blog or

watch our video. You can also

request a demo and we’ll talk you through Lipa Pay.