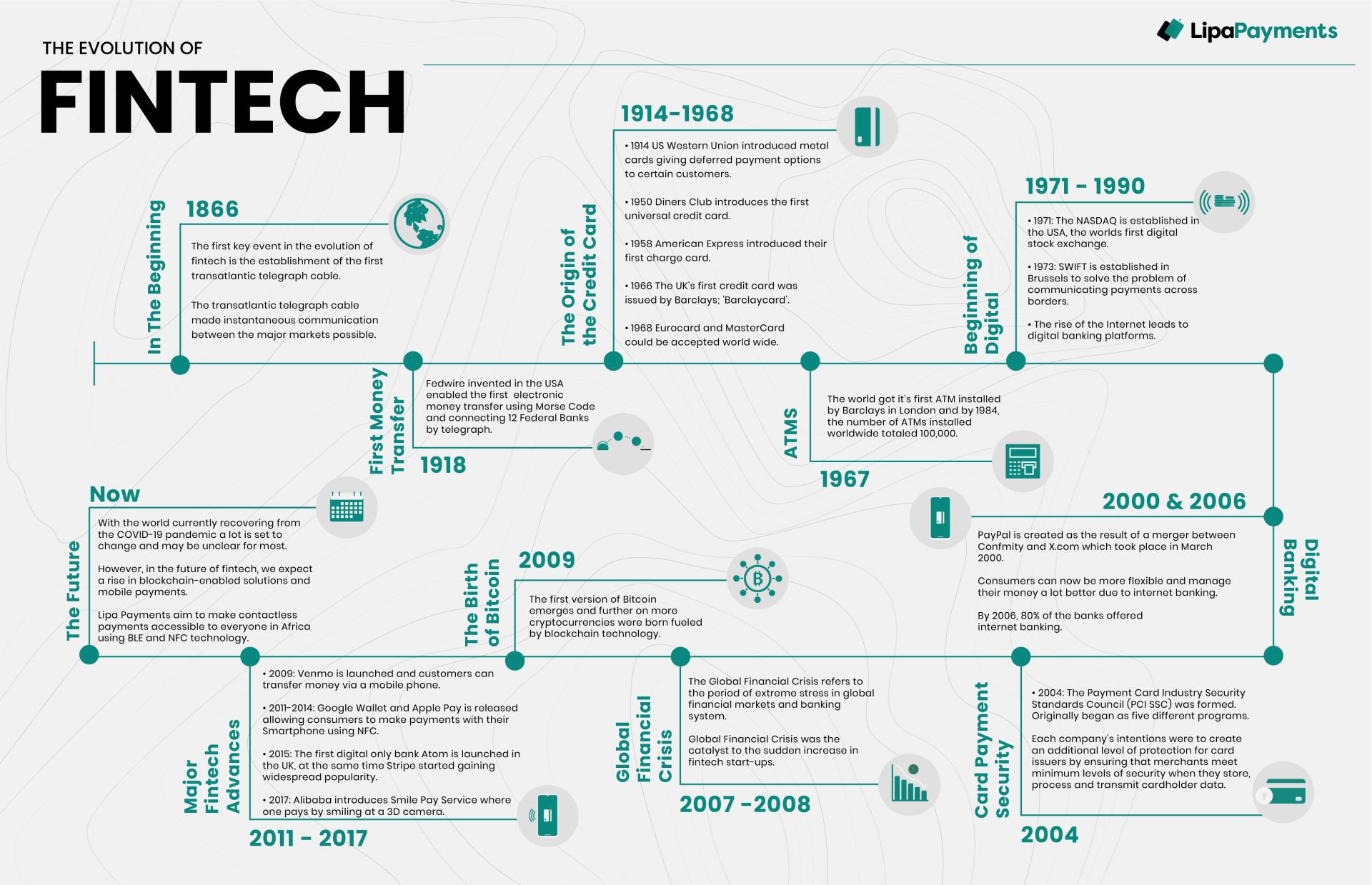

The Evolution of Fintech

Financial Technologies (“Fintech”) refers to the digital, online and mobile technologies that are used to support or enable financial services.

Fintech empowers consumers to take charge of their financial lives, leading to greater financial literacy than ever before.

Examples of fintech sectors include digital lending, insurance, mobile payments, cryptocurrency and blockchain, personal mobile banking, merchant services, etc.

But where and how did fintech start and where is it leading us to?

The Beginning (1858-1866)

The first key event in the evolution of fintech is the establishment of the first transatlantic telegraph cable. The transatlantic telegraph cable made instantaneous communication between the major markets possible.

First Money Transfer (1918)

Fedwire invented in the USA enabled the first electronic money transfer using Morse Code and connecting 12 Federal Banks by telegraph.

The Origin of the Credit Card (1914-1968)

- 1914: The US Western Union introduced metal cards, giving deferred payment options to certain customers, this became known as “metal money”.

- 1950: The Diners Club introduced the first universal credit card, these were plastic payment cards aimed at diners specifically. By the end of 1950 200 000 people were using Diners Club.

- 1958: American Express introduced its first charge card.

- 1966: The first credit card was issued by Barclay known as the Barclaycard, in the UK.

- 1968 Eurocard International and MasterCard International entered into a strategic alliance. This allowed for other cards to be accepted on each other's network, which meant that MasterCard could get an instant European acceptance network and EuroCard could get accepted worldwide.

ATMs (1967)

In 1967, the world got its first ATM installed by Barclays in London and by 1984, the number of ATMs installed worldwide totalled 100,000.

The Beginning of Digital (1971 – 1990)

- 1971: The NASDAQ (National Association of Securities Dealers Automated Quotations) was established in the USA, the world's first digital stock exchange.

- 1973: SWIFT is established in Brussels to solve the problem of communicating payments across borders. SWIFT is to this day the most commonly used communication protocol between financial institutions facilitating the large volume of cross-border payments.

During this time the use of the Internet started to rise and this led to the creation of digital banking platforms.

Digital Banking (2000 & 2006)

PayPal was created as the result of a merger between Confmity and X.com which took place in March 2000. The first online payment system. Consumers can now be more flexible and manage their money a lot better due to internet banking.

By 2006, 80% of the banks offered internet banking.

Card Payment Security (2004)

- 2004: The Payment Card Industry Security Standards Council (PCI SSC) was formed. Originally began as five different programs: Visa Card Information Security Program, MasterCard Site Data Protection, American Express Data Security Operating Policy, Discover Information, and Compliance, and the JCB Data Security Program.

Each company intended to create an additional level of protection for card issuers by ensuring that merchants meet minimum levels of security when they store, process, and transmit cardholder data. These companies aligned their policies and formed the PCI DSS.

Global Financial Crisis (2007 – 2008)

- 2008: The Global Financial Crisis refers to the period of extreme stress in global financial markets and banking systems.

The Global Financial Crisis was the catalyst for the sudden increase in fintech start-ups.

The Birth of Bitcoin (2009)

The first version of Bitcoin emerged and further on more cryptocurrencies were born fueled by blockchain technology.

Major Fintech Advancements (2011 – 2017)

- 2009: Venmo is launched and allows customers to transfer money via a mobile phone.

- 2011-2014: Google Wallet and Apple Pay is released allowing consumers to make payments with their Smartphone using NFC.

- 2015: The first digital-only bank Atom is launched in the UK, at the same time Stripe a payment service provider started gaining widespread popularity.

- 2017: Alibaba introduces Smile Pay Service where one pays by smiling at a 3D camera.

The Future (Now)

With the world currently recovering from the COVID-19 pandemic a lot is set to change and may be unclear for most. However, in the future of fintech, we expect a rise in blockchain-enabled solutions and mobile payments.

Lipa Payments aim to make contactless payments accessible to everyone in Africa using BLE and NFC technology.

The fintech industry is rapidly evolving and growing with so many opportunities and discoveries to be made. Lipa Payments is riding the wave of fintech growth enabling fintechs to accept contactless payments with ease.

Follow us by subscribing to our newsletter to receive all our latest insights and updates.