We’re excited to share the latest enhancements across the Lipa Payments ecosystem, introducing innovative features and improvements to elevate your experience. Among these updates, we made significant enhancements to our user interface (UI), ensuring a more intuitive and visually appealing interaction with our platforms.

Let’s dive into the updates:

Lipa SoftPOS:

Bank MID visibility:

Allowing merchants to effortlessly monitor the progress of their Bank Merchant ID (MID) application. Now, from their profile page, merchants can easily track the status of their application through the following stages:

- Not Started:

Indicates that the process has not commenced. In other words, the merchant has not received the onboarding email to initiate the application. - Check Emails:

Merchants are prompted to check their emails, signifying that an email has been sent, guiding them to take necessary actions for the application process. - Requested:

Confirms that the merchant has successfully submitted the required documentation, formally requesting a Bank MID. - In Progress:

Denotes that the application is actively being attended to in collaboration between Lipa and the acquiring bank. - Rejected:

Communicates that the Bank MID application has been declined. - Errored:

Indicates that an issue has occurred during the Bank MID application process, requiring attention and resolution.

This new feature provides merchants with transparency and control over their Bank MID application journey, ensuring a seamless and informed experience.

Alternative Payment Methods (APMs)

In the modern digital era, consumers prefer convenient and secure contactless payments. However, challenges arise when customers lack NFC-enabled cards, need an offline PIN, or face transaction limits. We've addressed this by introducing alternative payment methods in Lipa Softpos, offering flexibility with APM integration and Lipa Pay by link.

Key Advantages:

- Flexibility for Tenant:

As the Tenant, you now have the flexibility to incorporate a wide range of payment methods tailored to your merchants’ needs. - Enhanced Conversions:

Diversifying payment options contributes to increased conversions, transforming store visitors into purchasing customers. - Customer Satisfaction:

The expanded array of payment methods elevates customer satisfaction levels, enriching the overall shopping experience for your merchants.

Adding Alternative Payment Methods:

- Provider Relationship:

To integrate alternative payment methods, the Tenant needs an existing relationship with the desired payment service provider. - Custom Integrations:

Should you wish to add payment methods beyond Lipa’s offerings, providing necessary information enables seamless integration into Lipa’s system.

Lipa’s Pay-By-Link Integration:

- Seamless Integration:

Lipa now proudly offers the Pay-By-Link service through collaboration with Transaction Junction (TJ), serving as the service provider.

Lipa NFC SDK:

Security Updates:

Our SoftPOS solution has achieved certifications from both VISA and Mastercard, underscoring our unwavering commitment to delivering a secure payment solution. These certifications stand as a testament to our dedication to meeting the highest industry standards for transaction security.

Key Advantages:

- Rigorous Evaluations:

Our SoftPOS solution has undergone comprehensive evaluations, ensuring compliance with the stringent requirements mandated by EMVCo, PCI-SSC, and Card Scheme standards. - Assurance for Businesses:

Businesses utilizing Lipa Payments' certified SDK can now confidently assure their clients, including ISOs, payment facilitators, and acquirers, that their transaction security aligns with and exceeds the industry's highest standards.

This achievement reinforces our commitment to providing you with a cutting-edge and secure payment solution.

Push Amount

The Push Amount feature is designed to streamline the transaction process, this cutting-edge capability allows one to directly pass an amount to the SDK via an exposed API, without the need to manually enter an amount. significantly reducing the need for manual input by the merchant.

Key Advantages:

- Streamlined Transactions:

The Push Amount feature simplifies and accelerates transactions, providing a seamless experience for both merchants and customers. - Efficiency in High-Traffic Scenarios:

Ideal for high-traffic scenarios, this feature enhances efficiency by eliminating the time-consuming manual entry of payment amounts. - Error Reduction:

By automating the amount input process, the likelihood of errors is minimized, ensuring a more accurate and reliable transaction experience. - Fraud Prevention:

The reduced reliance on manual entry mitigates potential fraudulent activities associated with manual input, enhancing the overall security of transactions. - SDK Integration via API:

The Push Amount feature allows for the direct passage of payment amounts to the SDK through an exposed API, eliminating the need for manual amount entry.

Start Remote Transaction

The Start Remote feature is designed to remotely start a SoftPOS/Tap on Phone transaction from an external system, creating an integrated POS experience. This innovation unlocks the full potential of softPOS for payment acceptance, providing a modern and efficient solution.

Key Advantages:

- System Integration Simplicity:

The “Start Remote” feature allows retailers to effortlessly integrate their systems with the Lipa platform, paving the way for the utilization of softPOS for seamless payment acceptance. - SoftPOS Payment Acceptance:

With the new “Start Remote” feature, retailers can integrate their systems with Lipa, enabling them to utilize softPOS for accepting payments. - Integrated POS Experience:

The “Start Remote Transaction” feature enables the initiation of SoftPOS/Tap on Phone transactions remotely from an external system, creating a seamless and integrated POS experience.

Lipa Pay:

Receive Function

We introduced the all-new “Receive” function on Lipa Pay, empowering you to effortlessly receive money from fellow Lipa Pay users. Harnessing the power of BLE (Bluetooth Low Energy) technology, this feature ensures seamless fund transfers to your friends, family, or business associates.

The “Receive” function simplifies the process of receiving money within the Lipa Pay community, making transactions quick and hassle-free.

Lipa Web Services:

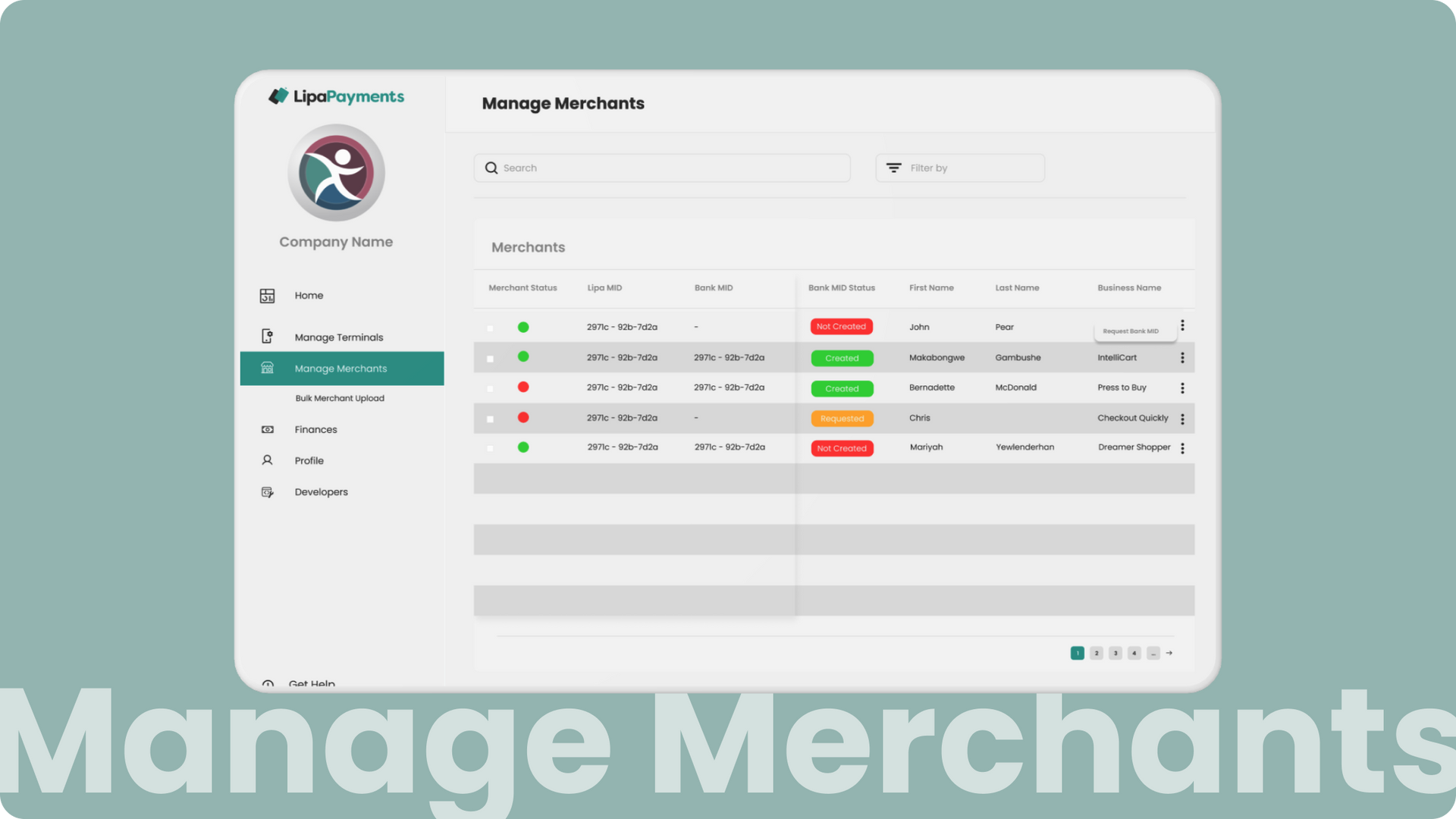

Manage Merchants

We’re thrilled to unveil the enhanced “Manage Merchants” feature, providing tenants with a comprehensive overview of their merchants through an intuitive table view to aid in their support to their merchants.

Key Features:

- Information Displayed:

- Merchant Status

- Lipa MID (Merchant ID)

- Bank MID (Bank Merchant ID)

- Bank MID Status

- Email Address

- First and Last Name

- Total number of terminals registered to the merchant

- Phone Number

- Business Address - Actionable Option:

Tenants can click on the menu at the end of each row to “Request a Bank MID” for an individual merchant. - Detailed Merchant View:

Clicking on an individual merchant in the table provides access to more information about the merchant and their registered terminals. - Search and Filter Functionality:

Easily locate a specific merchant by entering the terminal ID or Lipa MID in the search bar and filter merchants based on different bank MID status states.

This update streamlines merchant management, offering a convenient and efficient way for tenants to access, monitor, and interact with merchant details and associated terminals.

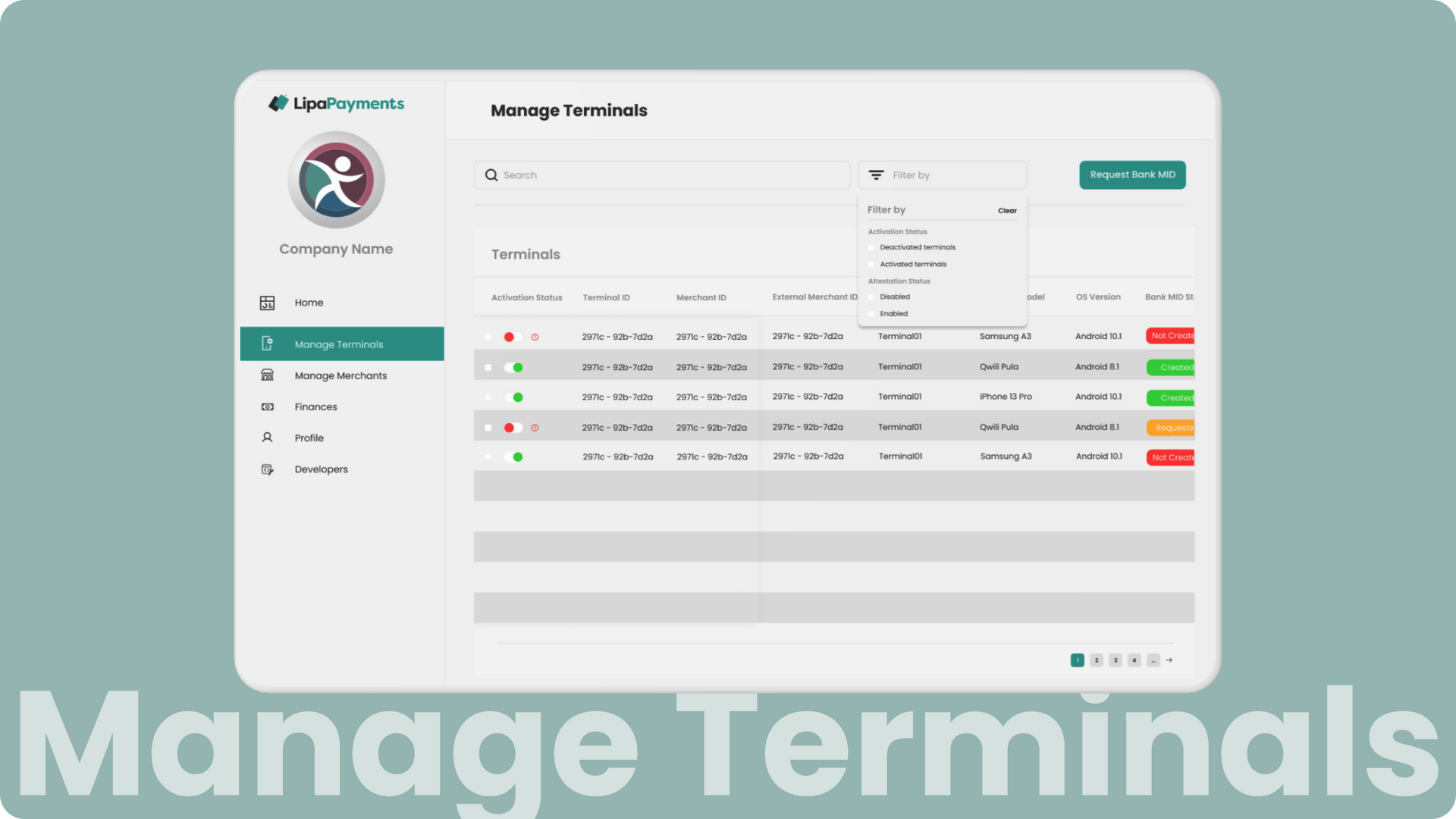

Manage Terminals

We’re excited to introduce the enhanced “Manage Terminals” feature, designed to empower tenants with comprehensive insights into their registered terminals through a user-friendly table view to aid in their support to their merchants.

Key Features:

- Information Displayed:

-Activation Status

- Terminal ID

- Merchant ID

- Merchant Origination (SDK or White-label)

- Current Operator ID

- Terminal Nickname

- Terminal Model

- Terminal OS

- Bank MID Status

- Attestation Status

- Last Attestation Check

- Registration Date - Actionable Options:

Tenants can click on the menu at the end of each row to perform actions such as “Resync a terminal” or “Delete a terminal” for individual terminals. - Search and Filter Functionality:

Tenants can easily locate a specific terminal by entering the terminal ID in the search bar and filter terminals based on activation status or attestation status.

This update provides a streamlined and efficient way for tenants to manage and monitor their terminals, offering greater control and flexibility in terminal operations.

Webhooks:

In today's interconnected landscape, seamless communication between systems is paramount. Introducing the Transaction Webhook—a powerful communication bridge within the Lipa Payments system. This feature ensures efficient conveyance of transaction information to other integrated systems, providing real-time updates. This eliminates the need for merchants and tenants to actively request transaction information.

Key Highlights:

- Seamless Data Transmission:

With this feature, webhooks seamlessly transmit transaction receipt data to designated recipient applications, enhancing the overall efficiency of data exchange. - Dashboard Empowerment:

Lipa now empowers tenants with a user-friendly dashboard to register, monitor, modify, and remove webhook endpoints. Take control of your communication preferences effortlessly. - Real-time Listening:

The introduced functionality allows recipient applications to actively listen for incoming HTTP POST requests, ensuring prompt and real-time data transmission.

In 2024, we plan to unveil additional features and updates for our products, with ongoing updates to keep you informed.

Excitingly, we've begun our PCI MPoC journey, aspiring to attain certification in the coming months.

Thank you for being part of the Lipa community. We look forward to shaping the future of seamless, secure, and efficient transactions with you. Chat to us here.

Get the latest Lipa Payments news & updates

Get the latest Lipa Payments news and updates

We will get back to you as soon as possible.

Please try again later.